Yaafa brand now alongside NBK Naanerie

Monthly result: €37,366.

Result since launch (12/22): €193,566.

This month has been extremely exciting as we achieved a similar revenue (with a few hundred euros difference) in click & collect compared to the previous month. The click & collect method now accounts for approximately 20% to 25% of our overall business, which is very encouraging.

Click & Collect

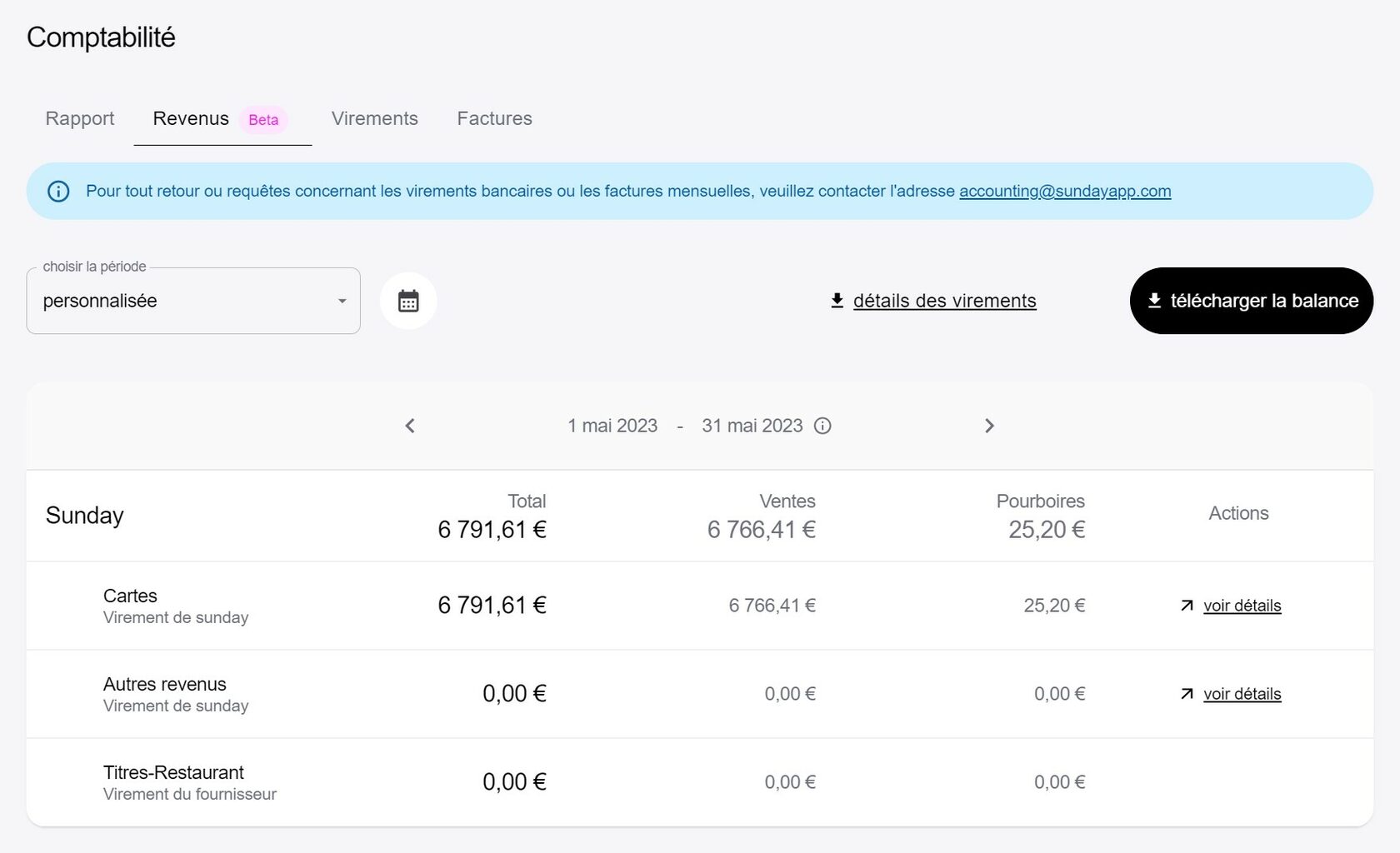

In May, we continued to utilize the Sunday App, a software developed by Parisian restaurateurs. Although we did not implement a specific strategy for takeout sales, we maintained effective communication in Grenoble, particularly on Instagram. The results were promising, with a revenue of €6,800, precisely accounting for 23% of our total sales for the month of May. These figures indicate a strong potential for direct sales through our communication efforts, but we could benefit from a more advantageous geographic location.

We will evaluate our click & collect revenue for the month of June, and if it does not show significant growth, it could indicate two things:

- We need to strengthen our communication to increase visibility.

- We may have reached our growth ceiling in this geographical area.

Based on this analysis, we will develop an appropriate strategy to address the situation.

We will evaluate our click & collect revenue for the month of June, and if it does not show significant growth, it could indicate two things:

- We need to strengthen our communication to increase visibility.

- We may have reached our growth ceiling in this geographical area.

Based on this analysis, we will develop an appropriate strategy to address the situation.

Deliveroo

On Deliveroo, we made the decision to stop sponsorships as they were becoming less effective. The cost per click was increasing, leading us to remove all our ads. However, we maintained our promotional strategy by offering a 15% discount on the entire order while keeping our prices 10% higher to preserve profitability. This offer allows our customers to enjoy a small discount while maintaining satisfactory order volumes. Additionally, it positions us at the top of the list within the Deliveroo app, providing us with better visibility to users.

This month, we achieved a revenue of €14,939.80 on Deliveroo.

Maintaining a promotional strategy on Deliveroo is relevant as the platform charges its commission based on the revenue after deducting the offers, unlike Uber Eats where the situation is different.

This month, we achieved a revenue of €14,939.80 on Deliveroo.

Maintaining a promotional strategy on Deliveroo is relevant as the platform charges its commission based on the revenue after deducting the offers, unlike Uber Eats where the situation is different.

Uber eats

Uber Eats has proven to be a costly platform. After nearly 8 months of use, it is undeniable that to appear at the top of the app, sponsored ads need to be published. Additionally, for these sponsored ads to be effective, it is necessary to have an online offer, and so on.

Furthermore, Uber Eats charges a commission on gross revenue, including our promotional offers. For example, if you decide to offer customers a €5 discount on purchases over €20, Uber will take a 30% commission on a revenue of €25, even though you only receive €20 in net revenue after deducting the offer.

On the other hand, Deliveroo applies a commission of 28% on net revenue, which is calculated on the actual revenue of €20 after deducting the €5 discount.

Despite this, Uber Eats remains the platform generating the highest volume of orders. Therefore, we have decided to continue working with them. However, we have made the decision to remove all promotional offers and sponsorships on this platform as we were approaching a 50% commission rate... For a revenue of €10,000, we would only receive €5,000 in net revenue.

We will explore other strategies for this platform that are also applicable to other sales platforms. While these new strategies may generate less volume than the tools offered directly by Uber, we will reduce our commission rate to a normal level, around 30%. This will significantly improve our profitability, and we will come out as winners. We explain this in detail in the following article.

Furthermore, Uber Eats charges a commission on gross revenue, including our promotional offers. For example, if you decide to offer customers a €5 discount on purchases over €20, Uber will take a 30% commission on a revenue of €25, even though you only receive €20 in net revenue after deducting the offer.

On the other hand, Deliveroo applies a commission of 28% on net revenue, which is calculated on the actual revenue of €20 after deducting the €5 discount.

Despite this, Uber Eats remains the platform generating the highest volume of orders. Therefore, we have decided to continue working with them. However, we have made the decision to remove all promotional offers and sponsorships on this platform as we were approaching a 50% commission rate... For a revenue of €10,000, we would only receive €5,000 in net revenue.

We will explore other strategies for this platform that are also applicable to other sales platforms. While these new strategies may generate less volume than the tools offered directly by Uber, we will reduce our commission rate to a normal level, around 30%. This will significantly improve our profitability, and we will come out as winners. We explain this in detail in the following article.

Harnessing the power of high-quality virtual brands

In May, we entered into a partnership with YAAFA (YOU ARE A FALAFEL ADDICT). Yaafa is a 100% vegetarian Lyon-based brand specializing in falafels. With their six restaurants in Lyon, they intend to expand their concept as a virtual brand or franchise in France.

This partnership has proven to be an excellent opportunity as we have a good synergy in terms of our menu, using the same basic ingredients for our sandwiches. Additionally, we do not require any additional kitchen equipment to operate their concept.

As a result, we now manage both brands in our Grenoble location. This presents new operational challenges, but we are now able to offer diversity to our customers and increase our presence on online platforms.

Operating Yaafa brings several advantages:

1. Generating additional revenue on online sales platforms by increasing our presence. As mentioned earlier, we have stopped all offers and sponsorships on these platforms, but we are present with another brand, allowing us to improve our profit margin.

2. Products: Yaafa prepares everything in-house and sends us the goods from their laboratory in Lyon. It's delicious, come and try it! Additionally, Yaafa has established strong partnerships with packaging suppliers and produce suppliers, which we can also benefit from for the NBK brand. They also enjoy advantageous rates from Metro as a privileged customer, and they kindly agreed to include our NBK product list with their rates, which will save us an average of 10% to 15% on our purchases.

3. Cross-marketing: We plan to advertise Yaafa at NBK and vice versa. In fact, we have already launched the Cheese Naan NBK X YAAFA, available on our menus. It's a cheese naan with falafels and Yaafa's homemade white sauce. A delight!

And what are the drawbacks of this strategy?

1. Operational aspects: We will need to efficiently manage both brands in the kitchen without sacrificing the quality of one for the other. At the moment, we don't have enough experience to discuss this in detail.

2. Products: Yaafa needs to ensure logistics between Lyon and Grenoble for the delivery of their fresh products. Given their delicate nature, we will test different solutions to maintain the quality of the products after transportation.

This partnership has proven to be an excellent opportunity as we have a good synergy in terms of our menu, using the same basic ingredients for our sandwiches. Additionally, we do not require any additional kitchen equipment to operate their concept.

As a result, we now manage both brands in our Grenoble location. This presents new operational challenges, but we are now able to offer diversity to our customers and increase our presence on online platforms.

Operating Yaafa brings several advantages:

1. Generating additional revenue on online sales platforms by increasing our presence. As mentioned earlier, we have stopped all offers and sponsorships on these platforms, but we are present with another brand, allowing us to improve our profit margin.

2. Products: Yaafa prepares everything in-house and sends us the goods from their laboratory in Lyon. It's delicious, come and try it! Additionally, Yaafa has established strong partnerships with packaging suppliers and produce suppliers, which we can also benefit from for the NBK brand. They also enjoy advantageous rates from Metro as a privileged customer, and they kindly agreed to include our NBK product list with their rates, which will save us an average of 10% to 15% on our purchases.

3. Cross-marketing: We plan to advertise Yaafa at NBK and vice versa. In fact, we have already launched the Cheese Naan NBK X YAAFA, available on our menus. It's a cheese naan with falafels and Yaafa's homemade white sauce. A delight!

And what are the drawbacks of this strategy?

1. Operational aspects: We will need to efficiently manage both brands in the kitchen without sacrificing the quality of one for the other. At the moment, we don't have enough experience to discuss this in detail.

2. Products: Yaafa needs to ensure logistics between Lyon and Grenoble for the delivery of their fresh products. Given their delicate nature, we will test different solutions to maintain the quality of the products after transportation.

Creating continuous novelty on the menu

McDonald's strategy of offering limited edition recipes that come back periodically is indeed very effective. We have innovated with several recipes since the launch, sometimes proposed by the NBK franchise (like the Winter Edition with raclette), sometimes created by ourselves (like the GPT), and each time, we have achieved good results. Last month, we mentioned that the GPT was one of our best-selling items, and this month, we launched the NBK x YAAFA featuring homemade falafels, which will now remain on the menu permanently. Next month, we plan to release the Forestier with mushrooms sourced from urban agriculture in Grenoble and a cream pepper sauce.

Limited edition recipes provide content for our communication, and the novelty appeals to customers who are curious to taste them. If they enjoy the recipe, they are encouraged to order more throughout the month because they know it's for a limited time. This approach creates a sense of urgency and exclusivity, which stimulates demand and encourages customers to try new flavors.

Next month, we will share the results of the Forestier recipe with you.

Limited edition recipes provide content for our communication, and the novelty appeals to customers who are curious to taste them. If they enjoy the recipe, they are encouraged to order more throughout the month because they know it's for a limited time. This approach creates a sense of urgency and exclusivity, which stimulates demand and encourages customers to try new flavors.

Next month, we will share the results of the Forestier recipe with you.